Premium Drag

Trading costs and delays in executing trades can significantly drag on returns for large asset managers, especially in small value stocks. Smaller, nimbler firms can avoid these issues by executing trades more efficiently because they don’t demand as much liquidity, thereby better capturing the value premium.

As an evidence-based investor, you care about maximizing returns through both buying stocks with higher expected returns and minimizing costs.

Trading costs can be a large hidden cost to investors that some asset managers try to minimize. For example, if you want to buy $10M of a megacap stock in a day, that’s easy because the stock trades several hundred million dollars a day. Your $10M trade will go largely unnoticed in the market.

In contrast, if you want to trade $10M of a small value stock, you may need to trade 100% of the daily volume for weeks to hit that amount. As an asset manager you would never want to participate in the market that aggressively because you would start driving the price up and, thereby, lowering your expected return. In addition, an investor needs and wants to trust the market price to inform them when to buy the stock. Thus, if you are dictating the price through heavy trading, how can you trust the price anymore? So, what do you do?

To reduce trading costs, stay hidden, and not impact prices, most evidence-based asset managers try to keep their daily trading volume to 2% or less of the total trades for that stock that day. This trading approach works great at low AUMs but incurs another cost to investors with larger AUMs.

Imagine a portfolio of 100 small value stocks all equally weighted at 1% each. If you are managing $1B in AUM that means you want $10M of each stock. If each stock trades $10M/day, and you participated at 2% every day, it would take you 50 trading days (~2 months) to reach your target weight. Further, research shows that small value stocks tend to remain small value for an average of four to five years before migrating to mid-cap or growth companies. Thus, taking two months to buy it isn’t too bad. You lost two months out of five years or about 3% of the value premium for that stock (In reality a little less because you were getting partial exposure to that stock during the two months of buying). On the plus side, you avoided overpaying for the stock and increasing your trading costs.

Now, assume you have $10B in assets instead of $1B. You now require $100M of each stock and instead of it taking 50 trading days it takes 500 trading days or almost two years to buy the stock. Now, instead of losing 3% of the value premium, you lose 40% of it. That is not a great trade off.

This is the hidden premium drag associated with large AUM firms. It may take over a year to buy into a position with higher expected returns, and conversely sell out of a position with lower expected returns creating a drag on performance.

Think about when you try to get off a plane. There is only one door for everyone to leave through. If the plane is full of people, it may take 30 minutes to deboard the plane. However, if the plane is only 10% full, it may take just a few minutes.

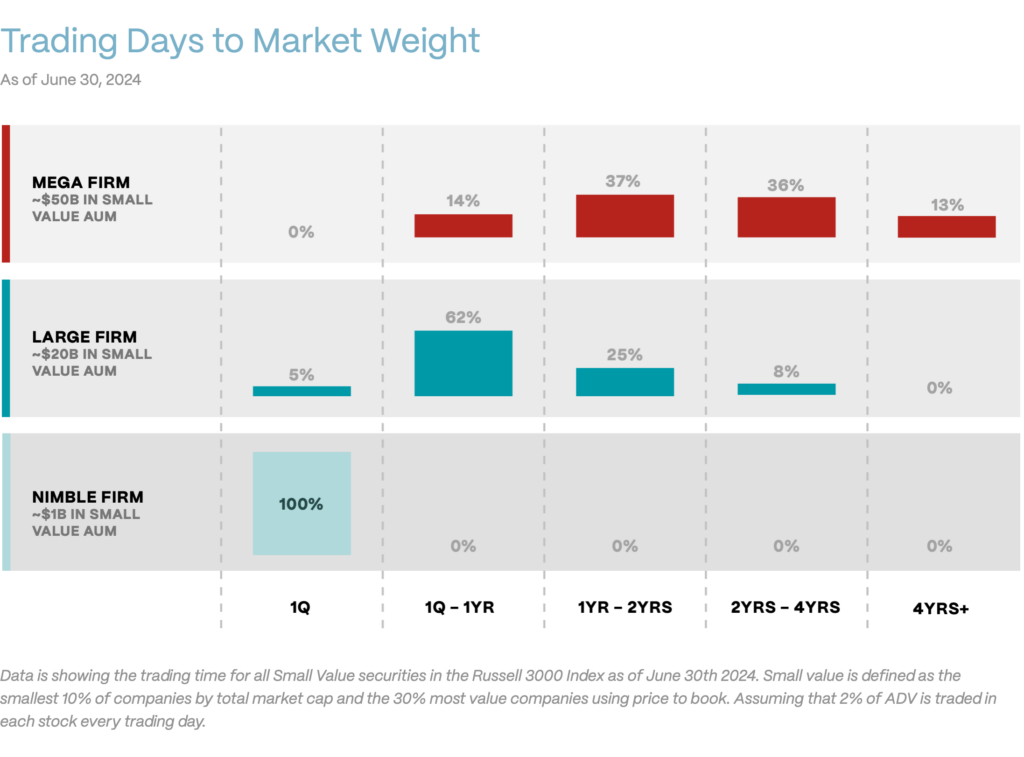

Let’s move from the hypothetical to the real world to see how this may impact various asset managers with different levels of assets in the small value segment of the market. When you evaluate the universe of small value US stocks (bottom 10% of size, 30% most value), there are about 900 securities. If you market cap weight the securities, you can determine exactly how long it would take to buy each security at various AUM levels assuming you trade 2% of the daily volume every single day.

As depicted above, it will take a large established firm with $50B in assets in small value securities across all its strategies (small value, small, total market all want small value securities) over two years to buy half of the securities. Two years!

Even at $20B in assets in small value means that a majority of securities will take over three quarters to buy. A smaller, nimbler firm with only $1B in small value can buy every single security in under 1Q. A smaller manager can access every security with higher expected returns immediately while also promptly divesting securities with lower expected returns.

When it comes to maximizing returns,

sometimes less really is more.

Download this article now (PDF), and browse other Educational Resources, in the Downloads section of our site.