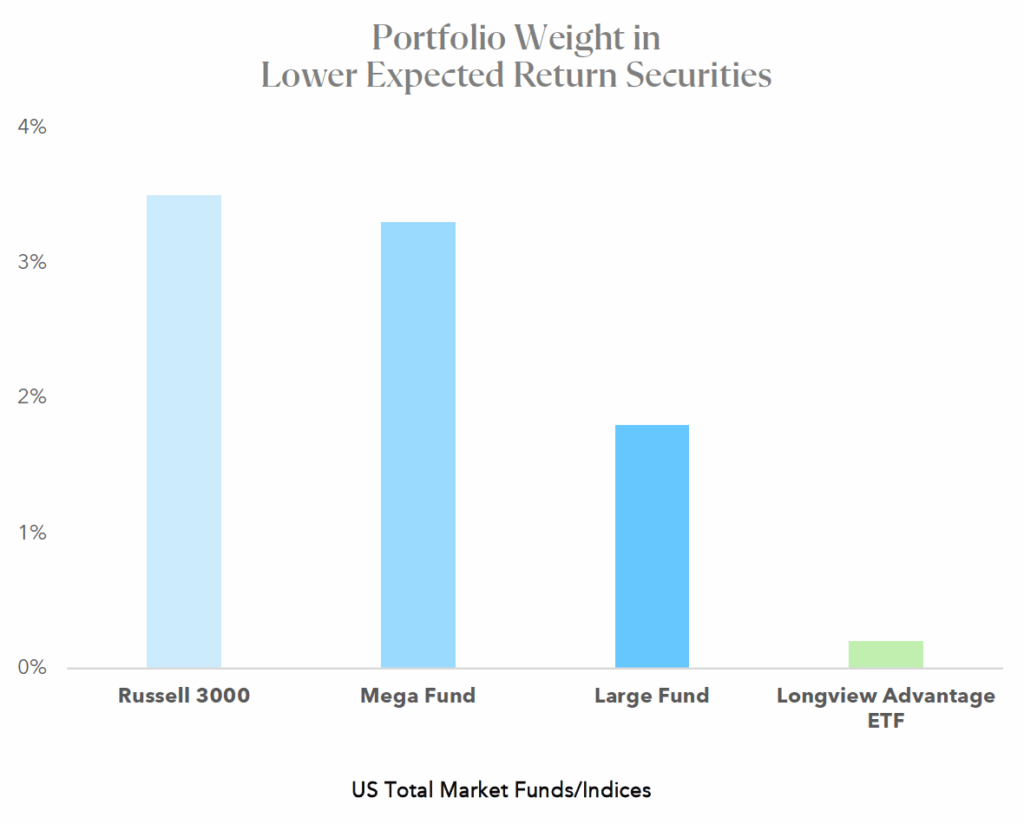

Divesting the Drag of Lower-Expected-Return Securities

In portfolio management, implementation efficiency is a critical yet often under appreciated source of excess return. The Longview Advantage ETF (EBI) leverages its nimble asset base to capture an expected implementation alpha of approximately 0.10% to 0.30% per year relative to larger evidence-based funds. This advantage stems from EBI’s ability to adjust exposures more rapidly as market prices and expected returns evolve. The negatives of large AUM funds can be easily quantified when considering the divestment of lower expected return securities. By executing trades promptly and without undue market impact, EBI continually minimizes exposure to these securities, thereby reducing implementation drag and maximizing expected returns.

Unless otherwise stated herein, Data as of 9/30/2025.

Source: Bloomberg for all holdings and security characteristic data. Lower Expected Return securities include High Asset Growth, Extreme Low Profitability-High Growth, and Cash Merger securities. High Asset Growth firms are defined as firms that grew their assets by >75% YoY. Extreme Low Profitability-High Growth Securities are defined as firms in the bottom 3% of the market based on their profitability and growth characteristics. Cash Mergers are defined as companies being acquired where the deal terms are > 50% cash.

You should consider the investment objectives, risks, and charges and expenses carefully before you invest in the Longview Advantage Fund (the “Fund”). The Fund’s prospectus or summary prospectus, which can be obtained by visiting www.longviewresearchpartners.com, contains this and other information about the fund, and should be read carefully before investing.

Active Management Risk. The Fund is subject to management risk as an actively-managed investment portfolio. The Adviser’s investment approach may fail to produce the intended result. Derivatives Risk. Derivatives may be more sensitive to changes in market conditions and may amplify risks. ETF Risk. The Fund invests in ETFs (Exchange-Traded Funds) and is therefore subject to the same risks as the underlying securities in which the ETF invests as well as entails higher expenses than if invested into the underlying ETF directly. New Fund Risk. The Fund is recently organized, which gives prospective investors a limited track record on which to base their investment decision.

Quasar Distributors, LLC – not affiliated with Longview Research Partners.